Email: [email protected]

Homeowners refinance their mortgages for an assortment of reasons. Some reasons center around strictly wanting to pay off their homes faster and at better interest rates, while others may fall along practical life events or emergencies. If you find yourself asking, “should I refinance my mortgage,” try checking off a few boxes to help come to a decision.

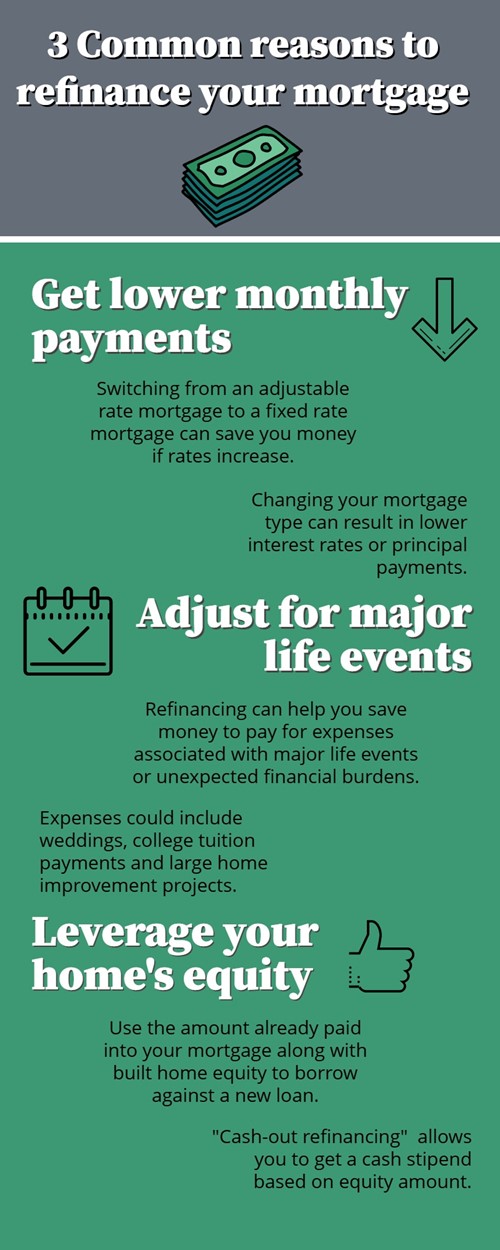

Here are a few reasons folks may refinance their fixed rate mortgage:

One of the more upfront reasons to refinance a mortgage is to make your monthly mortgage payments more affordable. Some may even seek to reduce their monthly payments by switching their mortgage interest type from an adjustable rate mortgage to a fixed rate mortgage, especially if the interest rates start to creep higher than anticipated.

You’ll want to consider your current loan term against the refinanced loan term to determine if adding extra years or higher principal payments is worth refinancing before jumping into a new mortgage. Sometimes, the monthly savings fall below the lifetime savings of the loan and may not be worth the extra refinance fees.

However, if you find refinancing your mortgage puts you in a great financial place, and you don’t have any large changes in income or expenses coming your way, it may be a perfect time to refinance.

Sometimes, you may find you want to refinance your mortgage for life events such as weddings, school tuition, large home improvements or other personal expenses. If you find yourself in an emergency, you may also want to consider refinancing.

Regardless of your life event, consult your current mortgage lender to ensure you can refinance without breaking any terms or conditions set forward by the original agreement. If you can refinance, be sure to keep your finances as close to budget as possible, so you don’t end up with more debt or financial hardships than is necessary.

After you’ve paid a decent amount into your mortgage loan, and have built some equity in your home, you can borrow more than your outstanding mortgage balance and receive the difference.

For example, if you’ve paid $50k into your current mortgage, with $150k outstanding, and want to refinance for a lower interest rate while getting more out of your home equity, applying for a new mortgage loan may be a great option. You could request $200k while using your home’s equity as a primary component for your new fixed rate loan.

Taking advantage of a “cash-out refinance” or “cash-out refi” gives you $50k to be placed back in your pocket for whatever projects or payments you want to use it for. Meanwhile, your new refinanced monthly payments may stay the same or lower, depending on the lender.

When refinancing your home, be sure to check in with your mortgage lenders. Some will offer you the options you’re searching for without having to switch to a new company that may not have your information on file or may request something deeper.

However, if you find a mortgage lender that checks all of your boxes, try contacting one of their loan officers to explore your options.

As a licensed real estate specialists you can rely on Khalid & Donna to help you reach your personal and financial goals whether you are - buying your first home, an investor, moving up, sizing down, refinancing or purchasing an investment property. Also great resource for homeowners who have a hardship & distressed property scenario and unable to keep up with the payments. Areas covered: Entire main Bay Area & all surrounding counties with extensive client portfolio of bought & sold properties. Have an extensive diverse background in the fields of Real Estate, and Program Management. I believe in helping and educating clients make informed decision in their real estate transaction that will meet their criteria and goals. .